Here’s to the weirdos

I’ve been telling startups to ignore the mainstream for a long time. Often, I see too many start ups try to tackle the middle without ever understanding the weirdos. The weirdos are where the future is at.

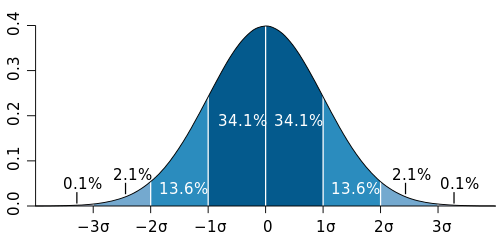

(credit: Wikipedia)

I’m going to paraphrase the “diffusion of innovations” theory by Everett Rogers. In a normal distribution, a standard deviation of 3+ will yield just 0.1%. These are your experimenters, those who will try anything once. A SD of 2+ is 2.2%. These are your innovators. A SD of 1+ is 15.8% are the early adopters. The vast, vast majority of companies will never get here. These three groups are the weirdos.

Startups are not trying to replicate the successes of existing industries. Startups are trying to invent something new, create value by destroying inefficiencies, create new industries, etc. In the world of startups, you don’t get to the destination by focusing on the destination. (That’s another blog post.)

You get there by focusing on your strengths and focusing on what you believe in. You sell that idea to the weirdos who believe in it when others won’t. Because in the world of disruptions, the destination doesn’t really exist – you’re going to have to make one as you get there and that means you’ll need believers.

And when I say “weirdos”, it doesn’t mean literally the people who walk around the streets who talk to themselves. I’m talking about those who believe passionately in the world you want to build for them.

I believe in a world where we, your friends and peers, are the funniest part of your day. A world where everyone has the ability, the tools, and the place to express their sense of humor. For a long time, and still to this day, Cheezburger has been called “weird” or “strange” or a host of other semi-negative terms. And I wear it with pride, because I know that the future is where today’s weird will become the norm.